HMBradley Visa

HMBradley Visa

PI-360 Product Monitor Profile

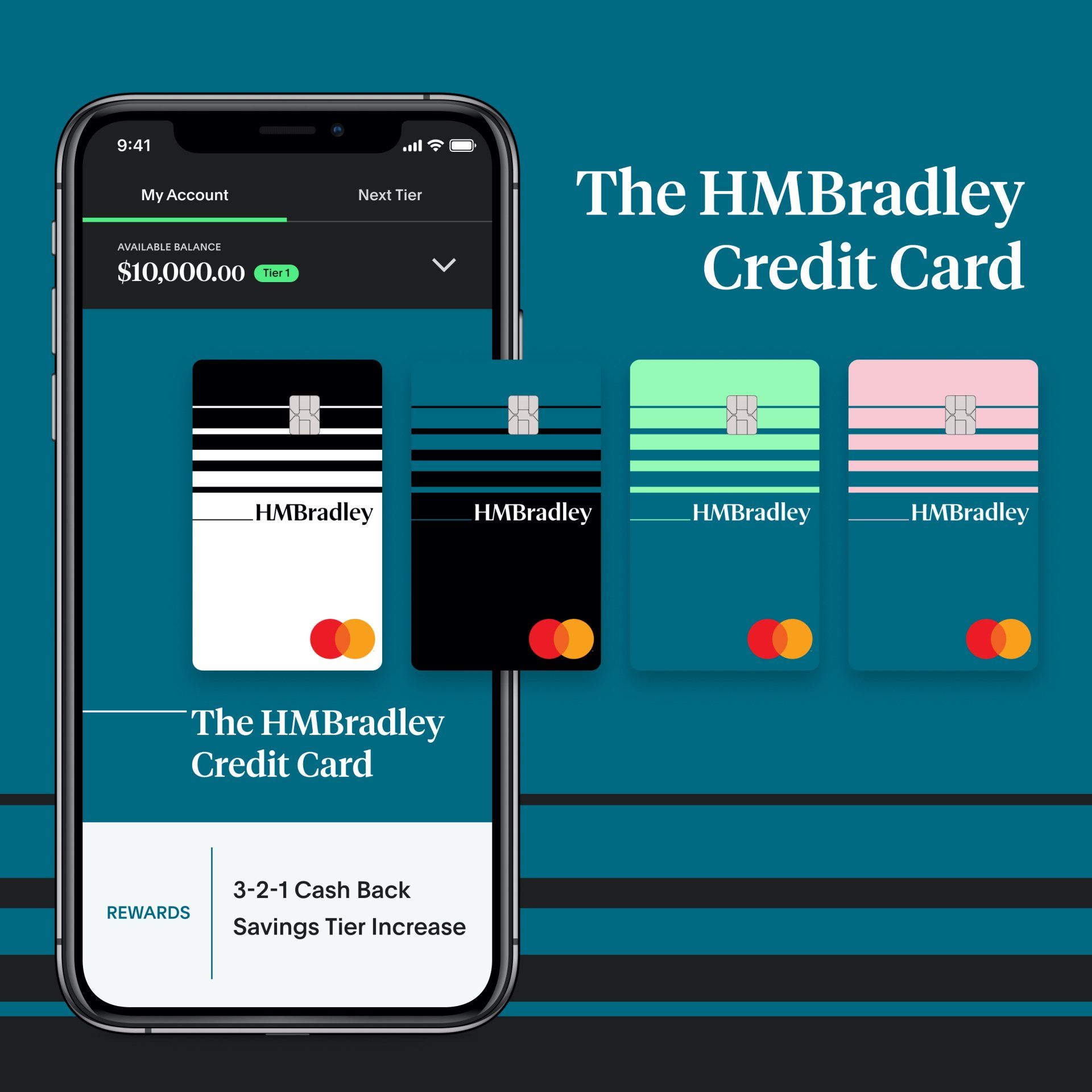

Long before Citi launched Citi Custom with smart rewards that adjust based on your spending patterns, there was the HMBradley Visa card. The HMBradley team figured out earlier than most that a large portion of younger consumers want better and simpler tools for saving money and building wealth. They started by designing a smart high yield savings account that allowed consumers to earn up to 3.00% APY with a simple principle in mind – the more you save, the more you earn. They then launched a first of its kind smart rewards credit card that aligned your cash back rewards based on where you spend most of your money AND offered APY savings boosters for active cardholders.

Was this a successful strategy for HMBradley? Yes, it was.

In their first year, HMBradley accepted more than $400M in deposits mostly from younger consumers with an average credit score of 740.

In fact, HMBradley grew so fast that they outgrew the capacity of their partner bank. (As partner banks take on more deposits, they need to raise additional capital to satisfy regulatory requirements.)

As HMBradley works to transition their accounts to the New York Community Bank, they are also streamlining their offering. While the exact details on their new credit card offer are still under wraps, we are confident that the spirit of their mission will remain the same, and that they will continue to innovate and inspire the rest of the market with their progress.

We connected with Zach Bruhnke, HMBradley's CEO to ask him about the impact that the HMBradley Visa has had, and will continue to have, on driving deposits and greater savings for his customer base and here is what he had to say:

"QUOTE"

Here is a look at the core differentiators of the original HMBradley Visa:

Competitive Set

When analyzing innovation across disruptive new offers consider product strategies employed by some of the other Financial Apps, Digital Banks, as well as emerging offers from some of the most established financial institutions. Access 4M+ consumer evaluations of every competitive product strategy to uncover what works well with this product and what is missing to drive engagement with key target audiences.

PI-360 is the only real-time innovation intelligence platform for the entire Payments market. Our data combines the deepest competitive insights on every core and fintech product with 4,000,000+ consumer evaluations of every payment feature and innovation in the U.S. market.

PI-360 interactive platform delivers these insights on-demand and in time for your next meeting.

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About PI-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.