Battle for Payments Share Begins

Subscribe to our Payments Innovation Blog for data and insights on your competitors and customer segments.

Contact Us

2 weeks

14 Brands

24 examples

of the new norm in card marketing

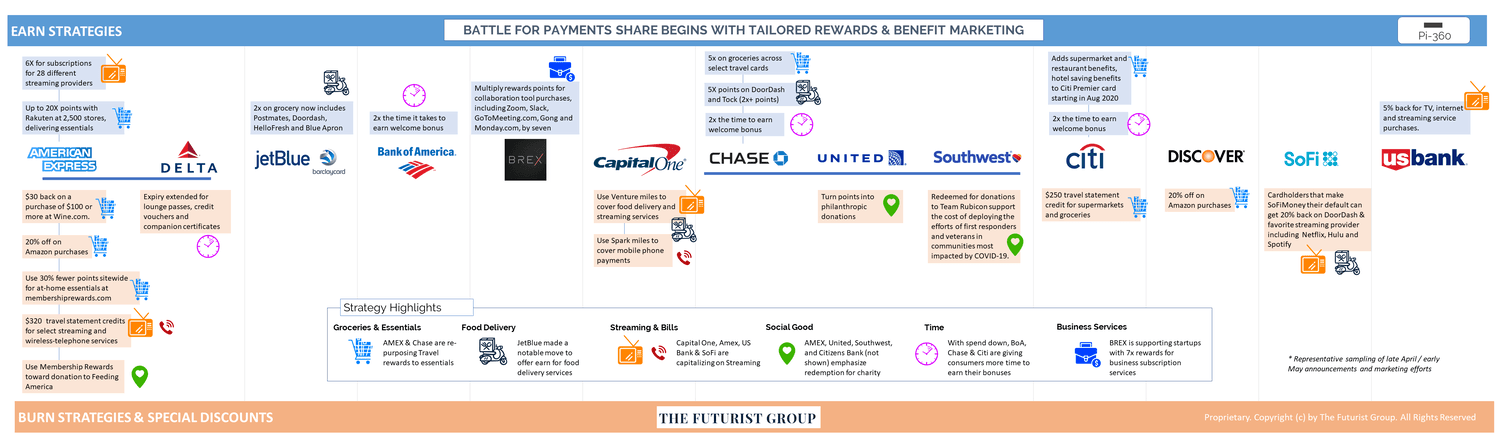

In early February we noted that traditional Credit Card Rewards Have Peaked, and that 2020 will bring a new focus on Benefit Marketing. While we relied on economic data, product profitability, and consumer insight to predict a 2020 shift toward an increased focus on value & relevancy in card marketing, no one could have predicted the current climate.

As payments volumes declined by as much as ~30% in April, and ~90% in categories like travel and leisure, the card industry had to react with hyper-focused messaging that connects with what consumers need and want today.

KEY TAKEAWAYS:

- The adjustments align with consumer data that we shared in March outlining that incentive marketing is a viable and desired alternative to deferrals for many cardholders.

- While some of the adjustments detailed in the infographic below are temporary, we believe that the approach of value-based card marketing is here to stay.

- Prior to COVID, due to lockstep movement in value prop innovation, mainstream providers were struggling to differentiate their offers. While these recent adjustments are highly appropriate, when we look at the entire landscape, and the fact that most issuers are uniform in their offers, we see the same challenge emerging.

- There is a need for breakthrough innovation that will allow providers to stand out from the competition with value propositions that are both relevant and unique in a highly competitive market.

Click on image to enlarge

WHAT COMES NEXT? | ACCESS OUR DYNAMIC DATA & METHODOLOGY TO IDENTIFY TRENDS AND PRACTICAL INNOVATION IN MARKETING AND PRODUCT DESIGN THAT WILL HELP YOU STAY AHEAD OF THE CURVE

- Access dynamic and custom analytics on every payments feature currently on the market (and innovative concepts that are not in market yet)

- Access reports on every competitor and their product

- Engage thousands of consumers in hours, not in weeks

Contact Us

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Read About Our Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.

Sources: The Futurist Group, Kantar Behavioral Payments Tracking