Incentive marketing

Sign-up for our Road to Recovery Index analysis that looks at consumer spend as a leading indicator of our recovery.

Contact Us

Incentive marketing is an alternative to deferral for card issuers

Article appeared in PaymentsSource on April 16, 2020

With payments volume contracting during the coronavirus outbreak, credit card issuers need to proactively adjust their offers to retain their share of consumer spend.

The month of March unfolded with rapid and devastating impact on almost every sector of the economy. In a span of weeks, travel, dining, retail, recreation, home improvement and other “go-to” categories for credit card rewards have been decimated by the pandemic.

While the primary focus for most credit card providers in March was on emphasizing fee forgiveness and payment deferral support, moving forward issuers need to focus on a mix of strategies to retain their cardholders' share of spend.

Here are a few important observations from our interviews with U.S. consumers:

- Financial support communication can take on many forms, and payment deferral is not the only option that consumers would welcome. There are many viable rewards strategies that issuers should be considering at this time.

- Accelerated rewards on household expenditures, such as paying for utilities, cable, and phone, are seen by many consumers as a viable form of financial support.

- For travel and dining credit cards, introducing accelerated rewards for all online purchases is a recommended strategy for staying relevant and top of wallet. This can also apply to any card that emphasizes merchant categories that have been impacted by the pandemic.

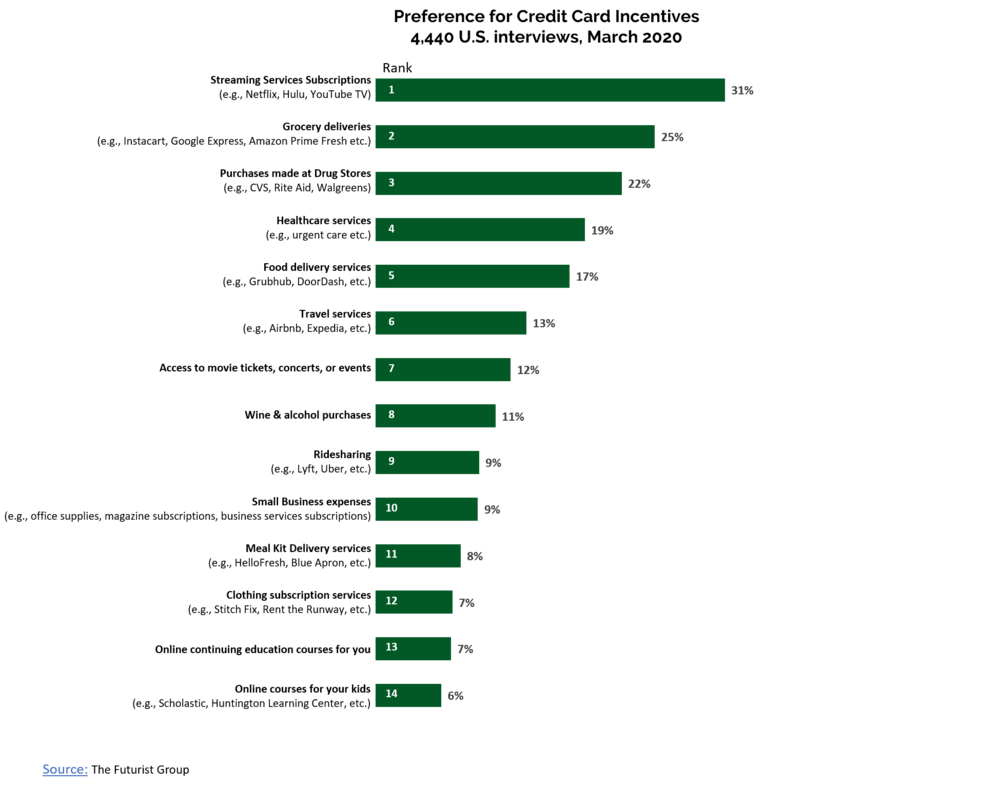

- When considering strategies for how to retain consumer spend, issuers need to align against the categories that matter to consumers today. In the analysis below, we can see a clear preference in accelerated rewards and benefits connected to streaming, grocery deliveries and health care.

Finally, in executing on any of these strategies, product managers need to ensure that consumer interest connects with increased product usage. With streaming, for example, there are more than a few strategies that an issuer can implement such as offering accelerated earn, subsidizing a trial, or offering an ongoing discount. Each of these approaches will have a different impact on product usage overall, and by consumer segment.

While everyone is concerned about managing the decreasing payments volume, here is another interesting statistic that emphasizes the need and urgency for proactive portfolio management at this time: In the month of March, there was a 27% increase in consumers shopping for a new credit card. The increase in credit-seeking activity was evident across all segments, including consumers with good to excellent credit. In this environment, issuers need to adapt quickly or stand the risk of losing share in what is likely to be a long-term economic downturn.

About The Futurist Group

The Futurist Group helps identify what’s next in payments, using modern technology, frictionless consumer engagement, and intelligent analytics to provide answers to the most important and forward-looking questions about the future of payments. Dedicated to the financial services space, The Futurist Group was founded by an experienced team of professionals from consumer intelligence, fintech, banking, analytics, and payments.

About Pi-360

A proprietary Product Innovation Intelligence Platform that maps and analyzes the entire competitive landscape through the lens of ongoing and structured consumer reviews. Imagine knowing everything that you need to know about your competitor’s products, emerging innovation, and consumer needs without waiting for research.

Road to Recovery Index: The best predictors of future outcomes combine behavioral and economic data with consumer sentiment. This is why we are partnering with Kantar Behavioral Payments Tracking and Pollfish to help our clients evaluate the near-term impact of COVID-19 on consumer expenditures. By combining actual spend patterns with economic and consumer sentiment data, we are creating forward-looking analytics that provide deeper context for where we are today and the path that we will need to take on the Road to Recovery.